37+ 2020 estimated tax payment calculator

This simple calculator can help you. And is based on.

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Our free tax calculator is a great way to learn about your tax situation and plan ahead.

. You can skip the final payment if. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Coronavirus Aid Relief and Economic Security CARES Act permits self-employed individuals making estimated tax payments to defer the payment of 50 of the social security tax on net. Doing 2020 Taxes Online Makes It Easy.

Instalment payments are generally due on April 15 June 15 and September 15 of the current year and then on January 15 of the following year. Prior Year 2020 Tax Filing. Use your income filing status deductions credits to accurately estimate the taxes.

Based on your projected tax withholding for the. If you expect to owe more than 1000 in taxes thats earning roughly 5000 in self-employment income then you are required to pay estimated taxes. Use this federal income tax calculator to estimate your federal tax bill.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. It can also be used to help fill steps 3.

To calculate your estimated taxes you will add up your total tax liability for the current yearincluding self-employment tax individual income tax and any other taxesand divide. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. 1040 Tax Estimation Calculator for 2022 Taxes Enter your filing status income deductions and credits and we will estimate your total taxes.

And is based on. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. 1040 Tax Estimation Calculator for 2020 Taxes Enter your filing status income.

Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. Ad File 2020 Taxes With Our Maximum Refund Guarantee. All Available Prior Years Supported.

Use your income filing status deductions credits to accurately estimate the. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Quarterly Estimated Tax Calculator - Tax Year 2020 Use this calculator to determine the.

37 2020 estimated tax payment calculator Kamis 01 September 2022 Edit. Your household income location filing status and number of personal. It is mainly intended for residents of the US.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. We can also help you understand some of the key factors that affect your tax return estimate. 1040 Tax Estimation Calculator for 2020 Taxes Enter your filing status income deductions and credits and we will estimate your total taxes.

Based on your projected tax withholding for the.

50 Free Excel Templates To Make Your Life Easier Updated August 2021 Excel Templates Budget Planner Template Personal Budget Template

Tax Deivas Llc Facebook

1

2

Top 10 Quickbooks Classes Courses Online 2022 Updated

2

Free Welding Invoice Template Example Welding Estimate Template Excel Estimate Template Invoice Template Repair Quote

3

Types Of Fintech Companies Ein Des Ein Blog

The Complete Guide To Bookkeeping For Small Business Owners Small Business Bookkeeping Bookkeeping Business Small Business Planner

Find Out Your Estimated Etsy Seller Direct Checkout And Paypal Fees Etsy Seller Fees Etsy Business Etsy

1

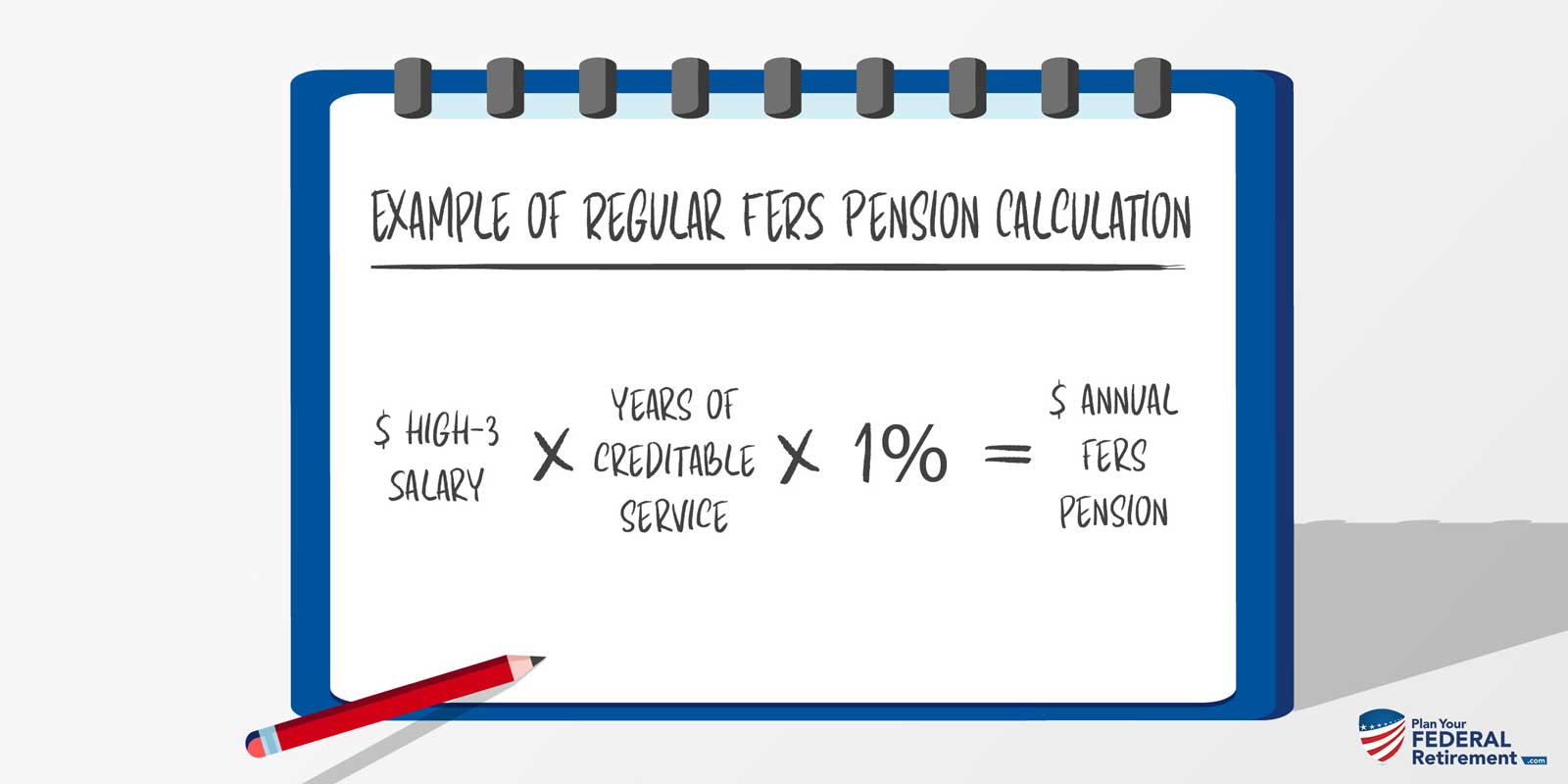

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

1

Tax Deivas Llc Facebook

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Why Am I Seeing This Ad